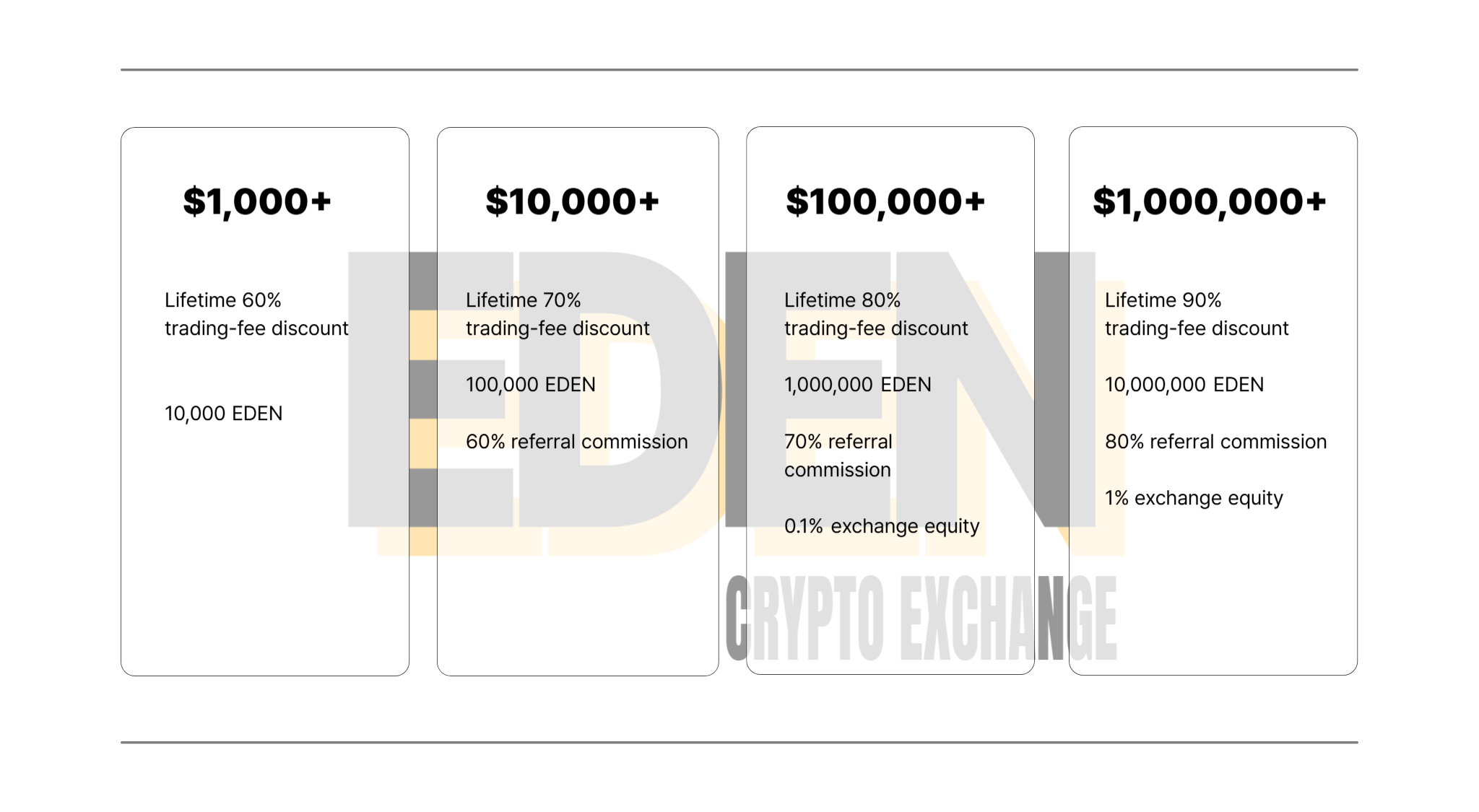

How to size your savings

Estimated monthly fees = your monthly trading volume × the standard fee rate.

Your savings = estimated monthly fees × your discount.

Example: at a 0.10% fee rate and $10M monthly volume, fees are $10,000. With a 70% discount you save $7,000 per month.

(Actual standard fee rates vary by market and tier.)

Referral economics

Payout = total fees actually paid by your referred traders × your commission rate.

Example: your referrals pay $20,000 in a month → at 60%, you earn $12,000.

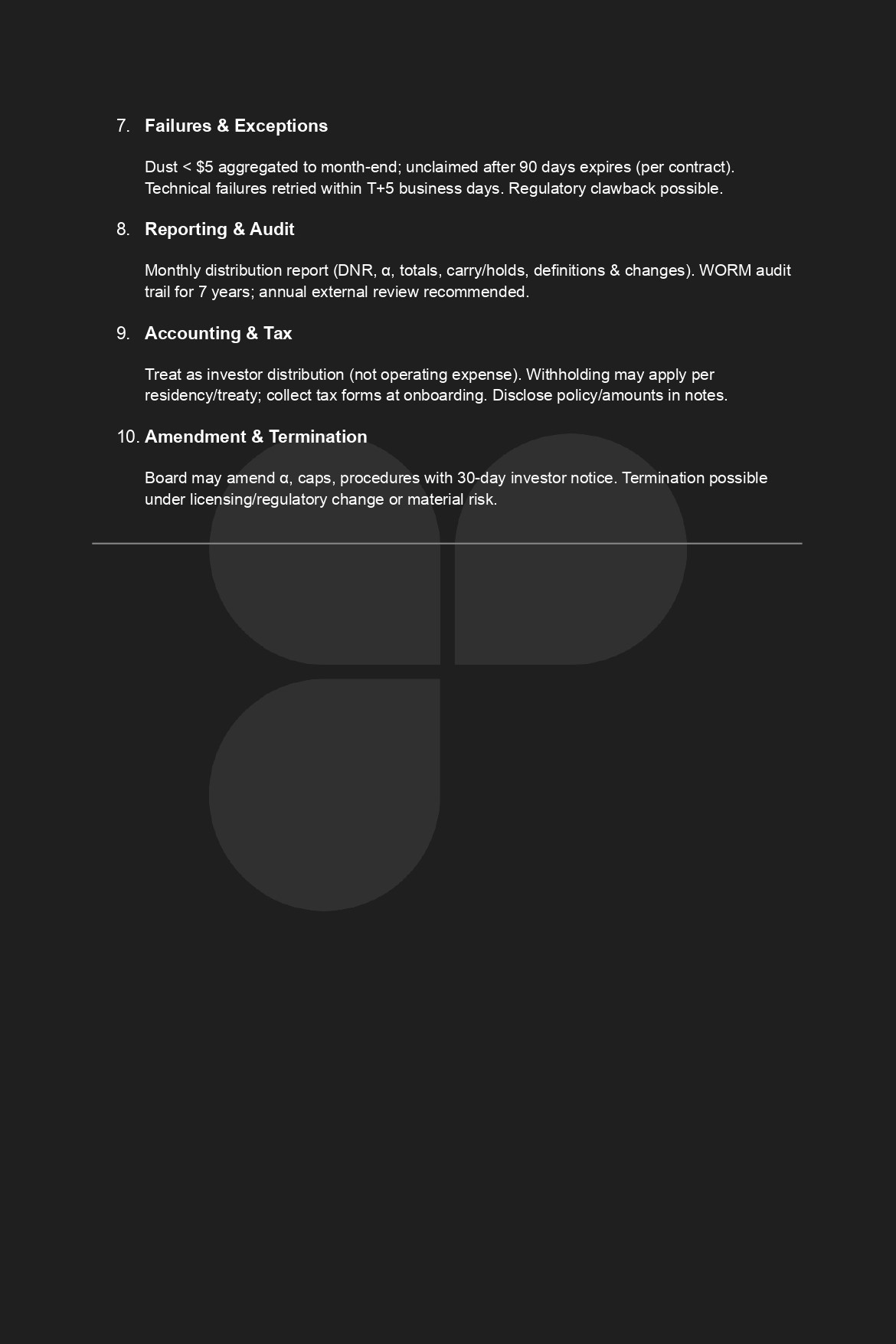

Equity & dividends

Dividend pool derives from operating profits primarily funded by trading fees.

Indicative formula: Dividend = Distributable Profit × Your Equity %.

Target cadence: quarterly or semiannual distributions with transparent reporting.

Final definitions (distributable profit, reserves, carryforwards) will be set in the program terms.

How to join

Send USDC to the EDEN treasury wallet.

Please message us on Telegram with:

the wallet address you sent from,

the wallet address to receive the tokens (Solana network only), and

your name or nickname

USDC ADRESS

Solana: “USDC (SPL) only. Solana network required.”

TOKEN

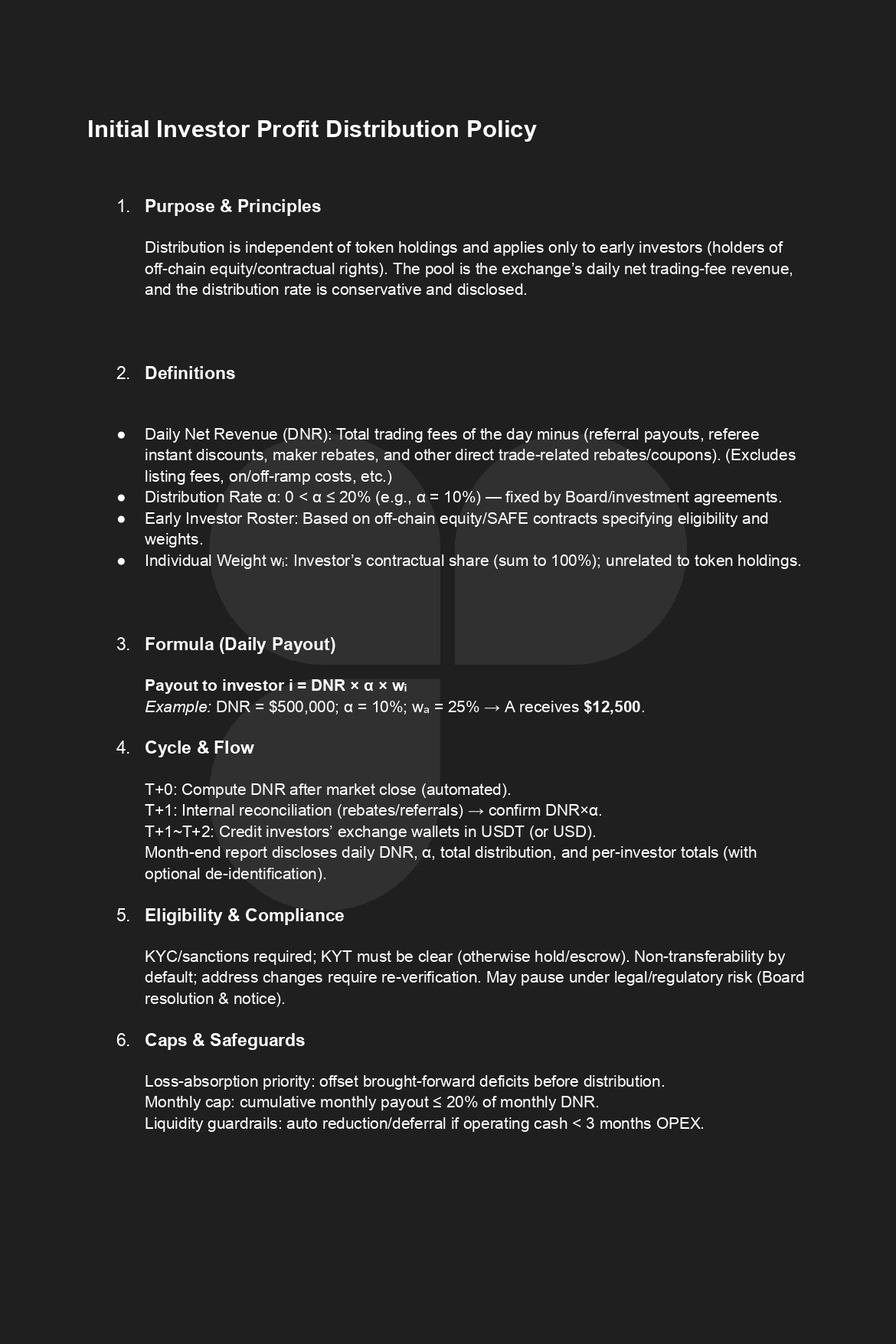

Dividend Structure

- Dividend pool: 15% of net trading fees collected across the exchange.

- Payout formula: Your Dividend = (15% × Net Trading Fees) × Your Equity %

- Example If quarterly net trading fees = $12,000,000 → pool = $1,800,000. With 0.10% equity, payout = $1,800,000 × 0.10% = $1,800.

FAQ

What is EDEN and what is its goal?

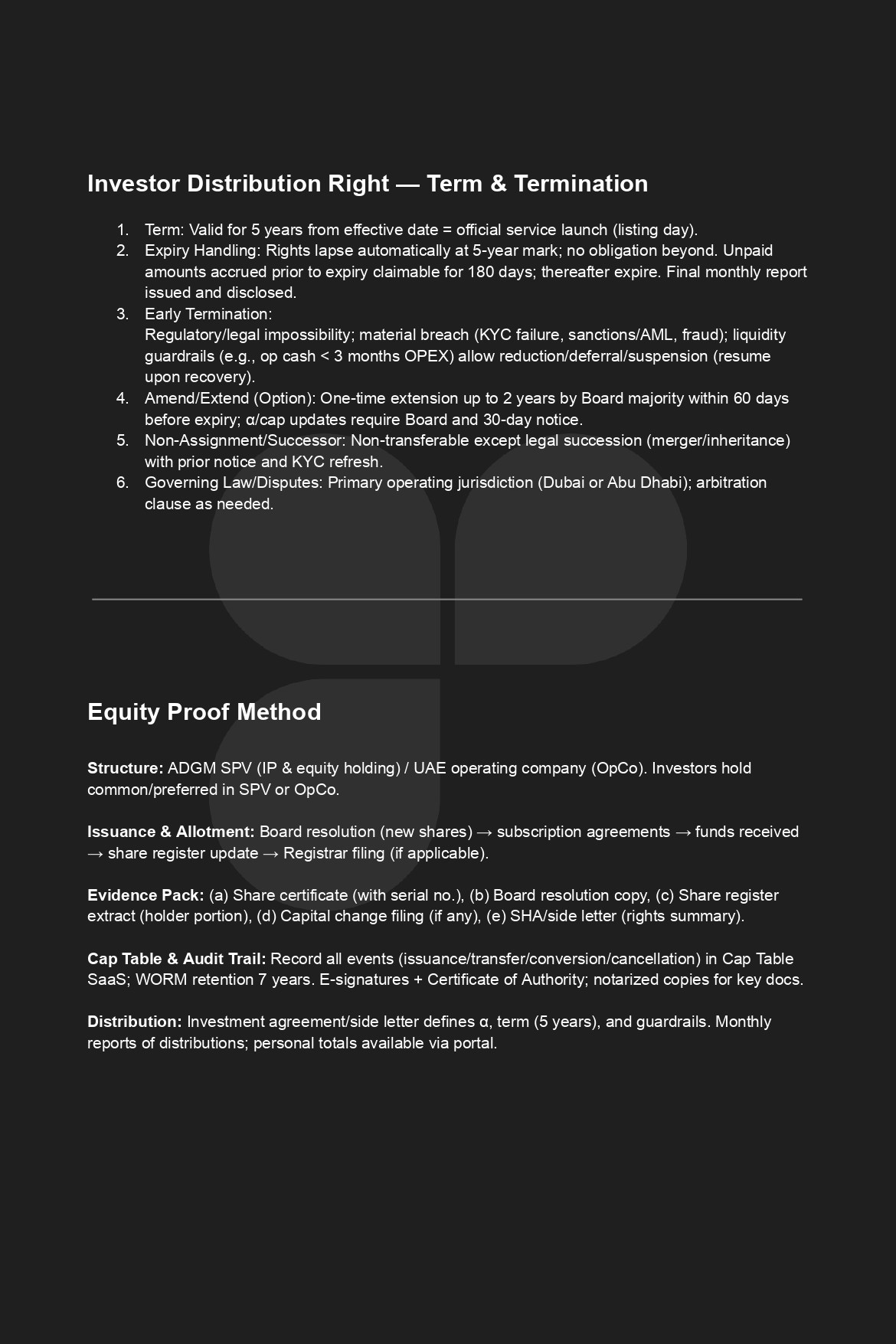

EDEN is a digital-asset organization jointly founded by anonymous investment institutions and professional traders. We aim to build next-generation trading infrastructure by standardizing withdrawal-first design, 1:1 reserves, and on-chain transparency to address asymmetries and withdrawal risks found in conventional exchanges.

Why should users trust EDEN?

We maintain 1:1 reserves for client assets, publish Proof of Reserves and wallet-routing rules, and operate multi-custody, multi-chain setups with withdrawal SLAs and emergency failover. In congestion or security events, partial openings and alternative routing minimize withdrawal delays.

How are governance and compliance managed?

A Founding Council and Risk/Audit Committee oversee risk limits, withdrawal policies, and reserve verification. We comply with KYC/AML/Travel Rule requirements, and token rights/disclosures follow non-securities mischaracterization principles based on jurisdiction-specific legal counsel.